The following section explains the overview of receipt and payment account format. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Both the Receipt and Payment Account and the Income and Expenditure Account are financial statements that summarize a company or organization’s financial activity over a certain period of time, typically a fiscal year.

Why You Can Trust Finance Strategists

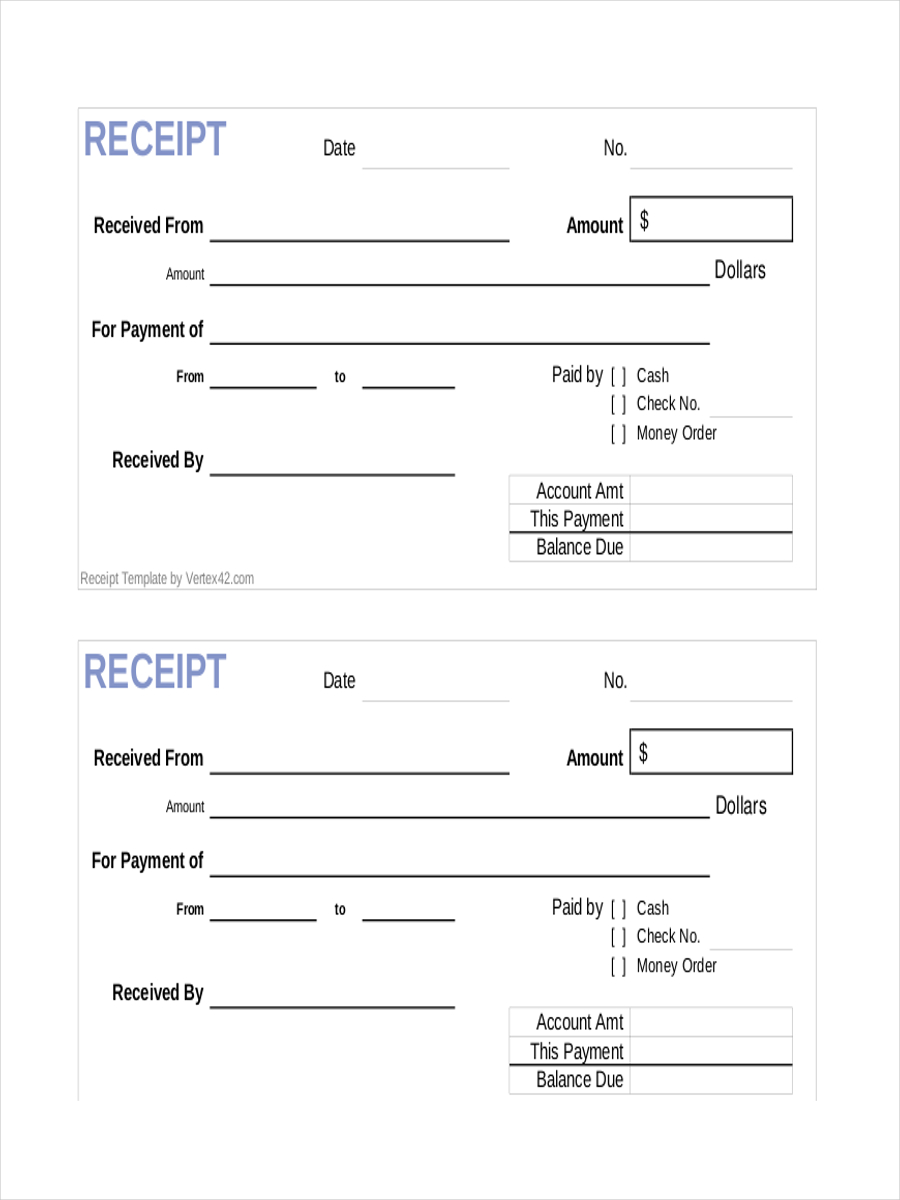

The difference between the total income and total expenses is the net income or loss for the period. All the receipts are written on the debit side and all the payments made are written on the credit side of the account. Receipt and Payment A/c fairly depicts the cash position of the organisation.

Get Your Questions Answered and Book a Free Call if Necessary

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Offering incentives like small discounts for immediate payments or providing multiple payment methods can motivate clients to pay faster. You can follow up with polite reminders and phone calls or even implement late payment fees if agreed upon beforehand in your contract. Politely and non-confrontationally remind the client of any payment terms, such as deadlines or late fees. “If there’s any issue or question about the invoice, please don’t hesitate to reach out. I’m happy to assist.”

Compare Actual Numbers with Budget

Any bank overdraft mentioned is to be taken as the first item on credit under the payments column. That was it for receipts and payment accounts and their advantages. This account records the amounts received and paid for each accounting year, and it also indicates the entity’s cash position. The main disadvantage of a receipt and payment account is that it does not provide a clear picture of the financial performance of an organization. It only records transactions as they occur and does not provide any information on the overall financial position of the organization.

Pushing too hard for immediate payments can come off as aggressive, which might harm your relationship with clients, mainly if they are used to longer payment terms like net 30 or net 60. Companies dealing with one-off transactions or direct deliveries, like wholesalers or retailers selling physical products, may use this term to ensure payment during product delivery. Non-Profit Organizations are organizations which are set up for the public or mutual benefit. Receipts and Payments Account is just like a Cash Account for them. It forms an important part of their accounting procedure since they have to deal with various donations throughout the year, which is mostly in cash.

Advantages of Receipts and Payment Account

- Now, we will find the difference between the total of the debit side and the total of the credit side of the account, the amount so found will be the closing balance of cash or bank.

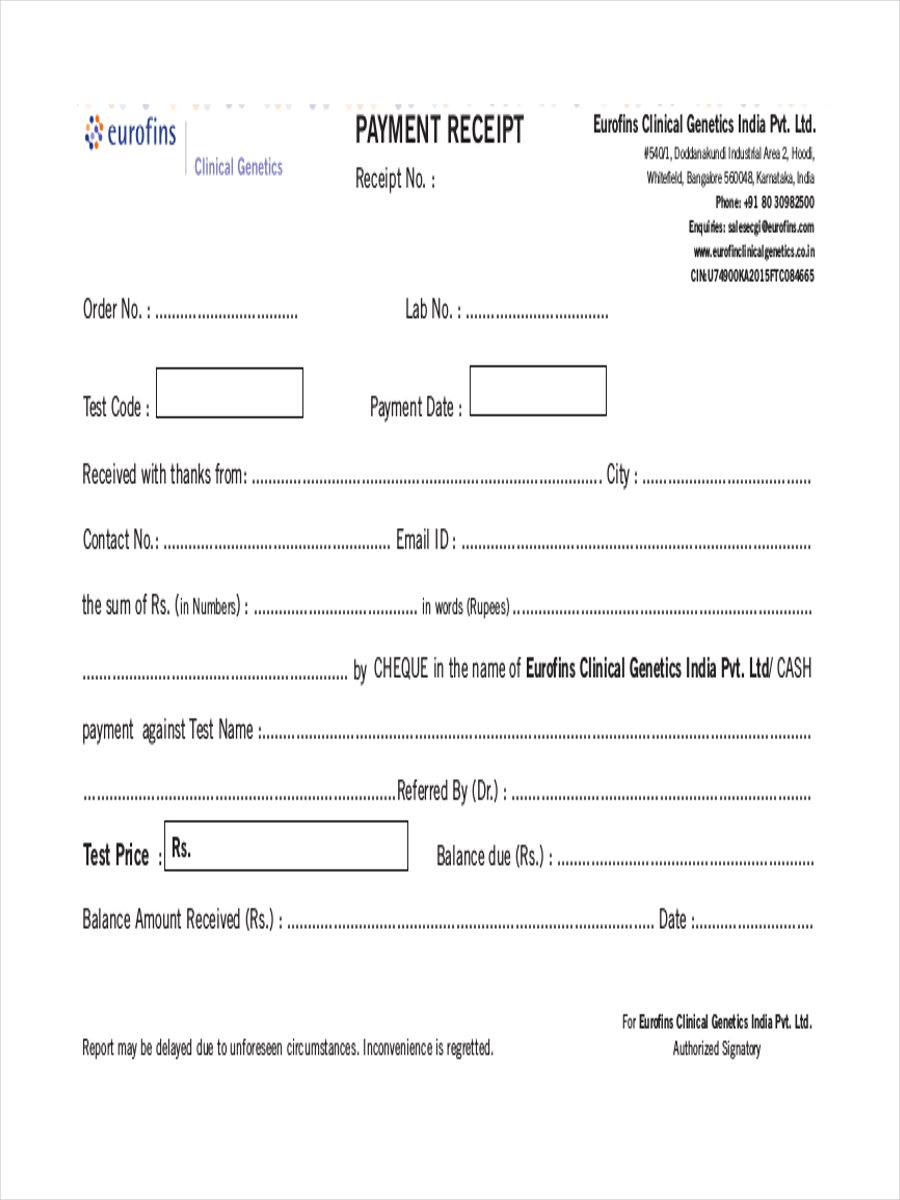

- A Receipt and Payment Account is a financial statement that is used to record all of the financial transactions of an organization, such as receipts (income) and payments (expenditures).

- The account records all the cash amounts whether they relate to the previous year, current year or upcoming year, received or paid during an accounting period.

- Hence, these organization does not make any distinction between direct or indirect, productive or non-productive, concerning incomes and expenditures.

- The left-hand side of this account is known as “Receipts” and right-hand side of this account is known as “Payments”.

Regular updates ensure you know your financial situation and can make informed decisions. Moreover, this account does not differentiate between the receipts and the payments, no matter what its nature. On top of that, it does not include any of the non-cash transactions in the form of depreciation. A Receipt and Payment Account is a financial statement that is used to record all of the financial transactions of an organization, such as receipts (income) and payments (expenditures). Prepare the receipts and payments account for The Old Mill Golfing club for the year ended 31 May 2024.

Receipts and payments accounts are made using a simple accounting form that summarises all money paid and received through the bank in cash by the charity during a financial year, besides a balance statement. educational institution mainly focus on Cash and Bank transactions, the account will show all cash received and all cash payments made during the period, and it will show the net cash balance at the end of the period. Now, we will find the difference between the total of the debit side and the total of the credit side of the account, the amount so found will be the closing balance of cash or bank. Now, we enter the total amounts of all receipts on the debit side and the total amount of all payments on the credit side (whether capital or revenue), and whether they are of past, current, and future periods.

Express willingness to help with any issues related to the invoice or payment to prevent unnecessary delays. Assume it was an oversight and gently remind them about the due invoice. By insisting on immediate payment, you limit your flexibility in offering clients different payment options, which could lead to lost opportunities, particularly with long-term or high-value customers. ‘Due Upon Receipt’ provides security against non-payment for new or higher-risk clients.

The receipts and payments account of a club and society is regarded as a summary of the cash book for the accounting period, in which all types of cash received by the organization are debited and all cash paid is credited. It does not include any outstanding expenditure or income, and it does not show actual income or expenditure for the period it covers. You have understood the overview of receipt and payment account format, but what about the benefits? An income and expenditure account shows the net surplus or deficit for an accounting period, whereas a receipts and payments account only shows cash transactions.

While receipt and payment account is a simple summary of cash and bank transactions. On the other hand, the income and expenditure account reflects the income and expenditure of the current year of the non-profit organization. It is prepared by taking out all the receipts and payment from the business cash book for the year. Here, if you talk about a cash book, each and every item is recorded separately and in chronological order.

Receipt and payment accounts are necessary to fulfil various governmental oversight norms. They also highlight the direction in which an NPO is going financially. Financial statements prepared by clubs, societies, and associations are different than those prepared by sole traders, partnerships, and limited companies. This book will teach you the basics of double-entry accounting, and it is a very important first step for any accountant. All other complicated accounting procedures are based upon this simple concept, and it will make everything else easy once you understand it.